By Priyadarshini Meena

Increasing exports in the textiles, leather, and apparels sector and the food processing industry, which employ the highest number of women, can help expand economic opportunities for India’s female workforce. This article tries to assess India’s recent trade trends and what has been the export growth in these sectors, vis-a-vis overall trade growth.

Women constitute 48% of India’s population, they only contribute 18% to the GDP. Their participation remains limited due to socio-economic barriers, lack of access to education, and limited support for women entrepreneurs. Addressing these challenges is crucial for leveraging the full potential of India’s demographic dividend and achieving its developed nation goal by 2047.

One of the channels for increasing women’s economic participation is via international trade. Research has found that trade can expand women’s role in the economy and decrease gender disparities by giving women more and better employment opportunities.

India’s trade landscape reflects a dynamic interplay of economic factors, global demand shifts, and industry-specific challenges, many influenced by geo-political conflicts. India is the fastest growing economy in the world today, ranked 14th in terms of total exports and 5th by GDP in 2024. Despite this, India’s GDP per capita and complexity index rankings underscore areas for potential growth and development, especially in women’s contribution to exports.

Trend in India’s exports over last few years

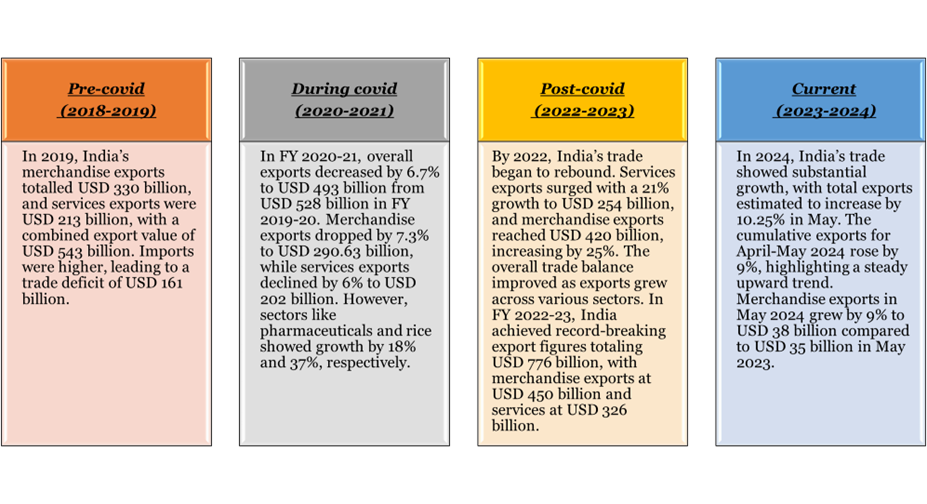

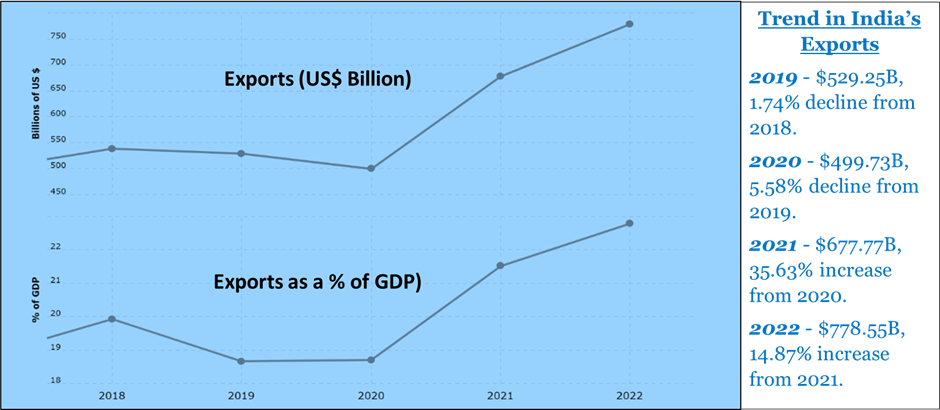

India’s trade has seen significant shifts over the years, with substantial growth in recent years.

India’s overall trade exports have seen a growth rate of 32.43% from 2018-2019 to 2023-2024, rising from USD 330.08 billion to USD 437.11 billion.

The key commodities with most exports in 2023-2024 were mineral products, electrical machinery, pearls and precious stones, nuclear and mechanical machinery, and pharmaceutical products.

- Mineral products surged by 82.81% to USD 87.6 billion, electrical machinery by 170.38% to USD 34.41 billion, while pearls and precious stones declined by 18.78% to USD 32.85 billion. Nuclear and mechanical machinery grew by 43.36% to USD 30.06 billion, and pharmaceuticals rose by 49.83% to USD 22.11 billion.

- Other commodities showing growth were vehicle (15.43%), organic chemicals (11.36%), iron and steel (21.73%), and their articles (36.33%), cereals (34.73%), and aluminium and its articles (34.15%)

- Some categories faced declines like articles of apparel and clothing accessories (6.38%), cotton (14.04%), plastic and its articles (7.91%), and fish and aquatic animals (2.12%).

- Miscellaneous chemical products (42.18%), other made-up textile articles (6.25%), optical instruments and apparatus (53.26%), and coffee, tea, and spices (48.10%) also showed substantial growth.

Women’s Share in India’s exports

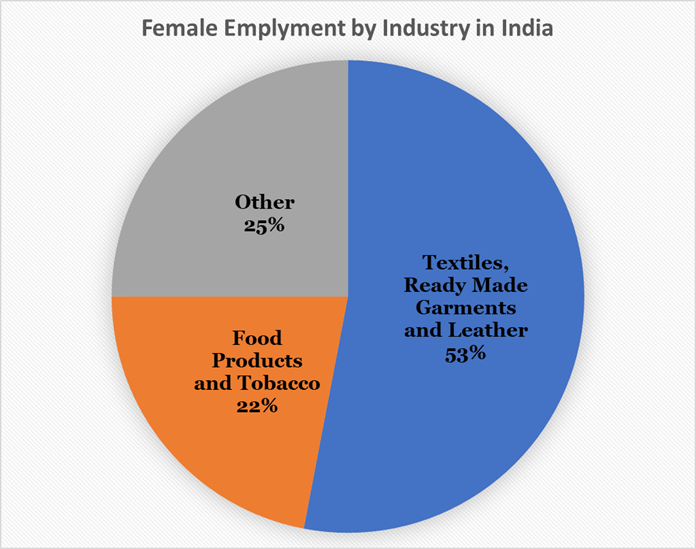

A look at the industry-wise share of female employment India shows that the majotity of women employed in manufacturing and related industries work in the the textiles, leather and apparel sector (53%), followed by the and food, beverage and tobacco sector (22%).

Given India’s industrial structure and gender composition of employment, one would expect that women could gain by being employed in sectors of comparative advantage. However, research shows that although women’s share of employment is higher than average in textiles, clothing and chemicals, which are also sectors of revealed comparative advantage (RCA), the relationship between comparative advantage and gender shares in employment is not strong.

Textiles, Leather, and Apparels Sector

The textiles, leather, and apparel sector in India stands as one of the largest employers of women in the country. However, between 2018-2019 and 2023-2024, the sector experienced a mixed performance, with some categories showing substantial growth while others faced significant declines. Overall, India’s total export in this sector saw a decrease of 8.40%, dropping from USD 41.98 billion in 2018-2019 to USD 38.46 billion in 2023-2024.

Several major commodities within this sector witnessed a decline in exports. Notably, articles of apparel and clothing accessories, both knitted and non-knitted or crocheted, saw decreases of 6.38% (from USD 8.34 billion to USD 7.8 billion) and 13.81% (from USD 7.82 billion to USD 6.74 billion) respectively. Cotton exports also declined by 14.04%, dropping from USD 7.89 billion to USD 6.78 billion, while the footwear sector saw a 14.37% decrease, falling from USD 2.91 billion to USD 2.49 billion. Other commodities that faced declines included articles of leather and animal guts (4.36%), man-made filaments (23.16%), staple fibers (13.96%), raw hides and skins (37.99%), special woven fabrics and embroidery (4.69%), wool woven fabric (16.83%), and furskins and artificial fur (8.56%).

Despite these declines, some categories showed promising growth. The “Other made-up textile articles, sets, worn clothing, and rags” category increased by 6.25%, from USD 5.26 billion to USD 5.59 billion. Wadding, felt, and nonwovens, along with twine, cordage, ropes, and cables, saw a notable 34.53% increase, from USD 427.32 million to USD 574.88 million. Impregnated, coated, covered, or laminated textile fabrics experienced a remarkable growth of 85.54%, rising from USD 258.42 million to USD 479.48 million. The headgear and parts category exhibited the highest growth rate of 110.20%, increasing from USD 45.79 million to USD 96.25 million. Other categories that experienced growth included vegetable textile fibers (6.14%), knitted or crocheted fabrics (7.21%), and silk (46.84%).

Food, Beverage, and Tobacco Sector

The food, beverage, and tobacco sector in India, which ranks as the second-largest employer of women in the country, has experienced a notable increase in exports from 2018-2019 to 2023-2024. Overall, the food, beverage, and tobacco sector demonstrated robust growth, with the total export value rising by 58.69%, from USD 10.41 billion in 2018-2019 to USD 16.51 billion in 2023-2024.

Several key commodities within this sector showed significant growth. Sugars and sugar confectionery more than doubled, surging by 102.04% from USD 1.63 billion to USD 3.29 billion. Residues and waste from the food industries, along with prepared animal fodder, rose by 45.30%, from USD 1.92 billion to USD 2.78 billion. The category of animal or vegetable fats and oils, along with their cleavage products, grew by 66.26%, increasing from USD 1.10 billion to USD 1.82 billion. Miscellaneous edible preparations also saw substantial growth, rising by 90.73% from USD 770.22 million to USD 1.47 billion. Meanwhile, edible fruits and nuts showed a modest increase of 1.22%, with an export value of just USD 20 million.

Other categories that exhibited significant growth include preparations of vegetables, fruit, nuts, or other plant parts (96.44%), preparations of cereals, flour, starch, or milk, and pastry cooks’ products (53.45%), preparations of meat, fish, and aquatic invertebrates (67.81%), and beverages, spirits, and vinegar (38.61%). The products of the milling industry, which include malt, starches, inulin, and wheat gluten, experienced the highest growth rate in the sector, skyrocketing by 124.34% from USD 321.31 million to USD 720.84 million.

However, cocoa and cocoa preparations saw a slight decline of 4.67%, dropping from USD 192.69 million to USD 183.7 million, making it the only major commodity in this sector to experience a reduction in export value.

Conclusion

Despite numerous challenges, especially in the wake of global disruptions like COVID-19, India’s trading sector has shown notable resilience and adaptability. Enhancing women’s participation in trade is crucial for India’s economic growth, given their current underrepresentation despite comprising nearly half of the population. The textiles, leather, and apparels sector, which employs the highest number of women, has shown overall declines in trade, while the food, beverage, and tobacco sector, the second-highest employer of women, experienced impressive growth. Addressing socio-economic barriers through better education, entrepreneurial support, and targeted policies are vital steps toward leveraging India’s full economic potential. By prioritising these areas, India can enhance its trade performance and progress toward its vision of becoming a developed nation by 2047.